is nevada a tax friendly state

A major casino destination gaming taxes account for 27 of the states general revenue funds. 84 Median Property Tax Rate.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada has an effective rate of 676 for all state taxes or 4058.

. 00 Effective Property Tax Rate. 06 Delawares property taxes are. Furthermore what are the most tax friendly states.

Social Security benefits even those. 644 per 100000 of assessed home value Low income taxes are. 49 Effective Sales Tax Rate.

Average Combined State and Local Sales Tax Rate. Nevada is the place if you love a dry climate and the desert as your backdrop. State Income Tax Range.

Nevada is a very tax-friendly state. Social Security income is not taxable. Is Nevada a tax.

754 in taxes per 100000 of assessed home value Average state and local sales tax. The lack of state income taxes alone make Nevada more. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Here are the nine best states for retirees wanting to. Its home to one. Heres how taxes are imposed in Nevada.

4 out of 5 of the most tax-friendly states saw population growth at or above the national. But even if youre not into the desert travel up towards Reno for a change of pace. Nevada is certainly still a tax friendly state especially as compared to states like California where we moved from.

In fact you will be hard pressed to find a better state to live in based on taxation. Three states on the list Wyoming Nevada and Florida dont have any income tax. The absence of state income tax alone is reason enough to call Nevada home.

The base state sales tax rate in Nevada is 46. Because Nevada is one of. Robert Davis Nevada is one of the nations most tax-friendly states and saw a 15 population increase in 2020 according to an analysis by personal finance website.

839 Gas taxes and fees. A Tax Friendly State There are many individuals and businesses who are motivated to relocate to Nevada by the fact that Nevada does not impose a state income tax. Nevada does have a pretty high 814 combined state and local sales tax rate but property tax rates are low at just 75 taxes paid as a percentage of owner-occupied housing.

Counties in Nevada collect an average of 084 of a propertys assesed fair. Nevada has long been a tax-friendly state for both individuals and businesses in the Silver State. Most tax-friendly Average property tax.

Total Tax Bill for the Average Family. 5461 Effective Income Tax Rate. Inheritance and estate tax.

Nevada is an excellent state to live in with no income tax and negligible property taxes. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265.

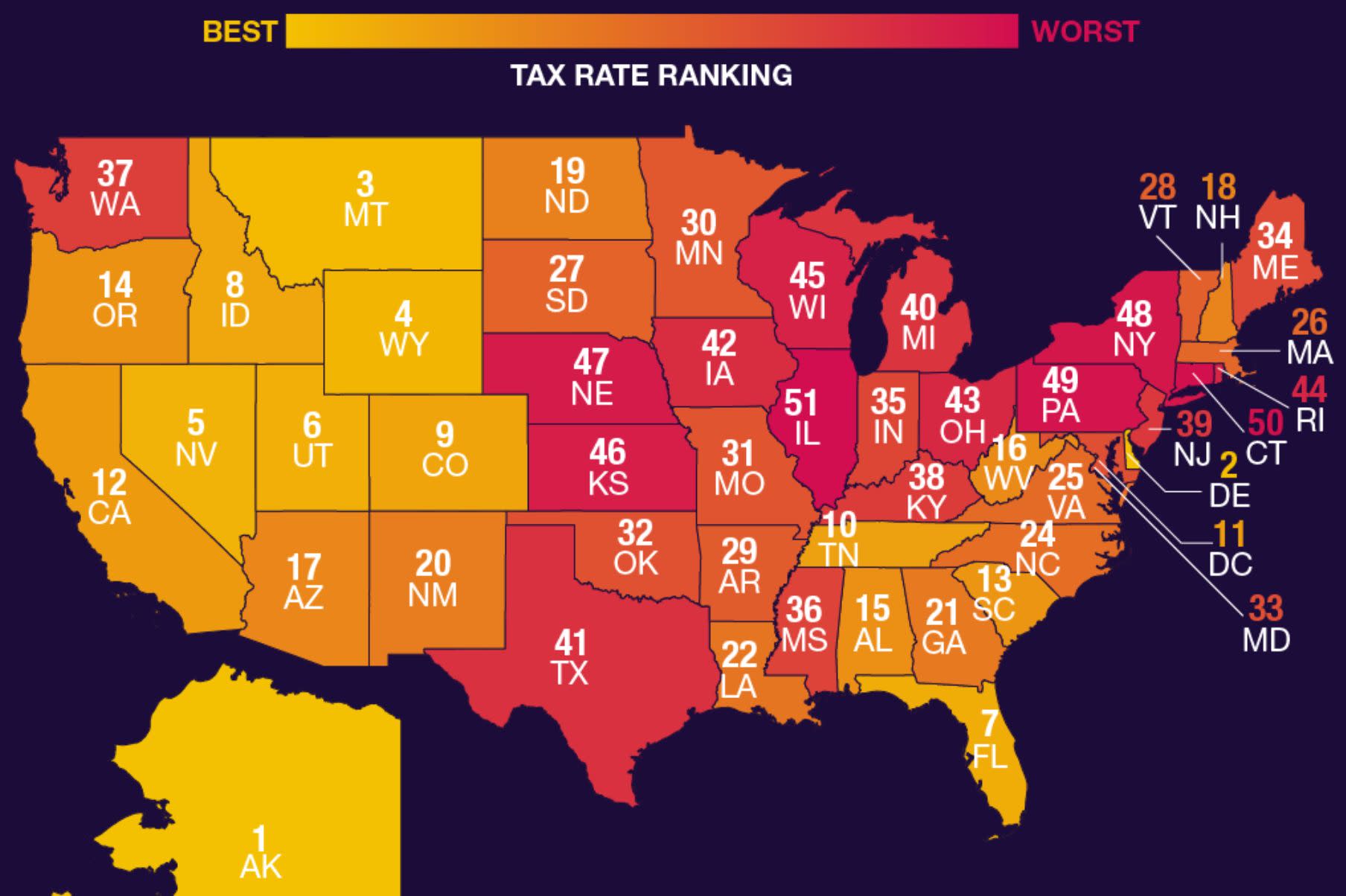

The Best And Worst U S States For Taxpayers

Hawaii Ranked 4th Least Tax Friendly State Honolulu Civil Beat

Study Reveals Most Least Tax Friendly States How California Compares Ktla

Center For State Tax Policy Tax Foundation

These Are The Best And Worst States For Taxes In 2019

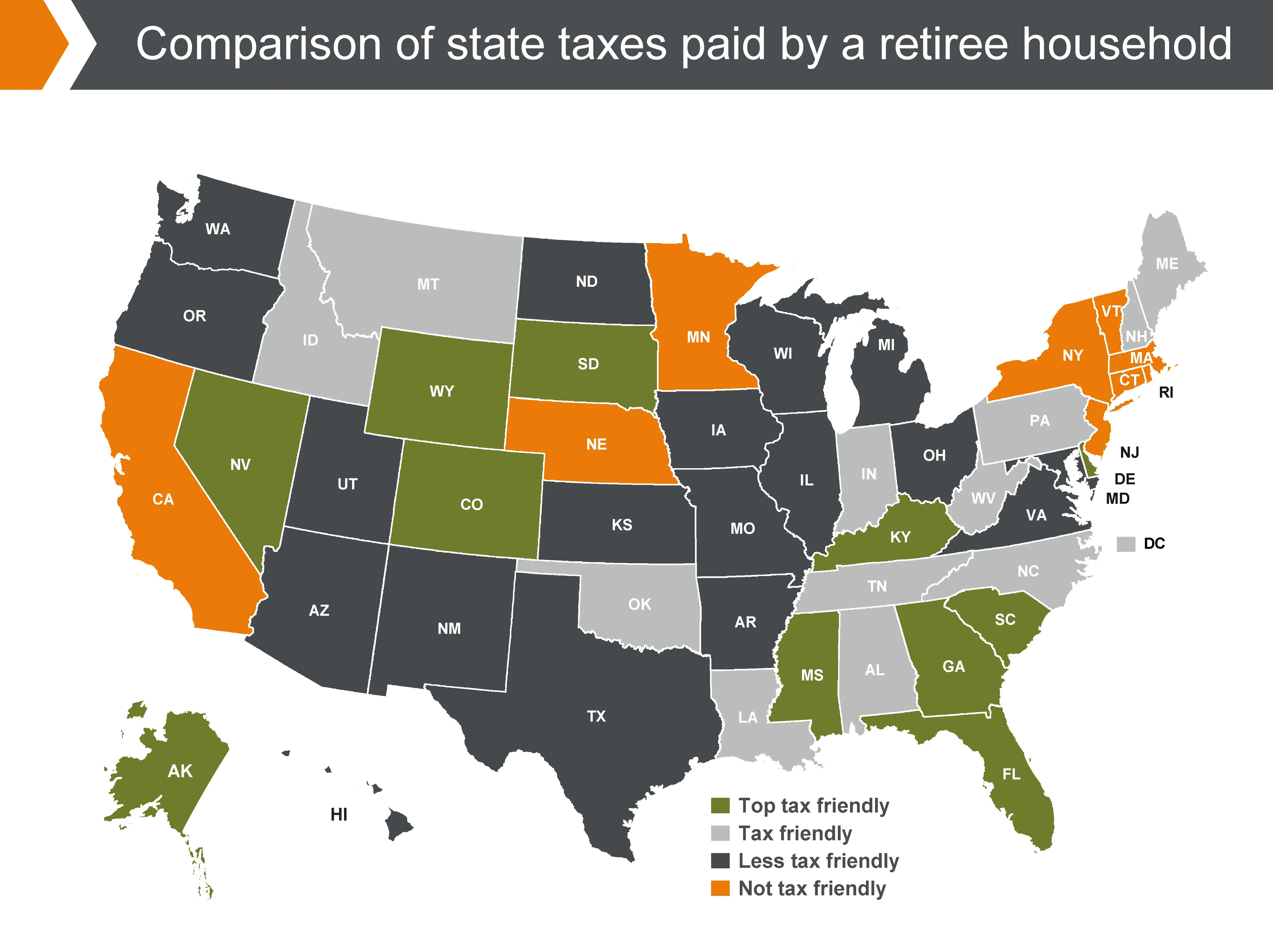

Tax Friendly States For Retirees Best Places To Pay The Least

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

The Most And Least Tax Friendly Us States

7 States That Do Not Tax Retirement Income

Nevada Tax Advantages And Benefits Retirebetternow Com

Corporate Tax Rates By State Where To Start A Business

Nevada Retirement Tax Friendliness Smartasset

States With The Highest And Lowest Taxes For Retirees Money

Nevada Is No 2 Among The Most Tax Friendly States Livewellvegas Com

Tax Friendly States For Retirees Best Places To Pay The Least

States With No Estate Tax Or Inheritance Tax Plan Where You Die